On February 1, 2025, the U.S. government announced that it would impose a 25% tariff on Mexico and Canada and a 10% tariff on China. This measure is expected to have a significant impact on the global trade environment.

A White House spokesperson dismissed foreign media reports on the announcement as “false” and claimed that the countries subject to the tariffs are responsible for the supply of illegal fentanyl. This suggests that the decision involves not only economic measures but also political and diplomatic factors. As a result, diplomatic conflicts between the U.S. and the affected countries are likely to intensify.

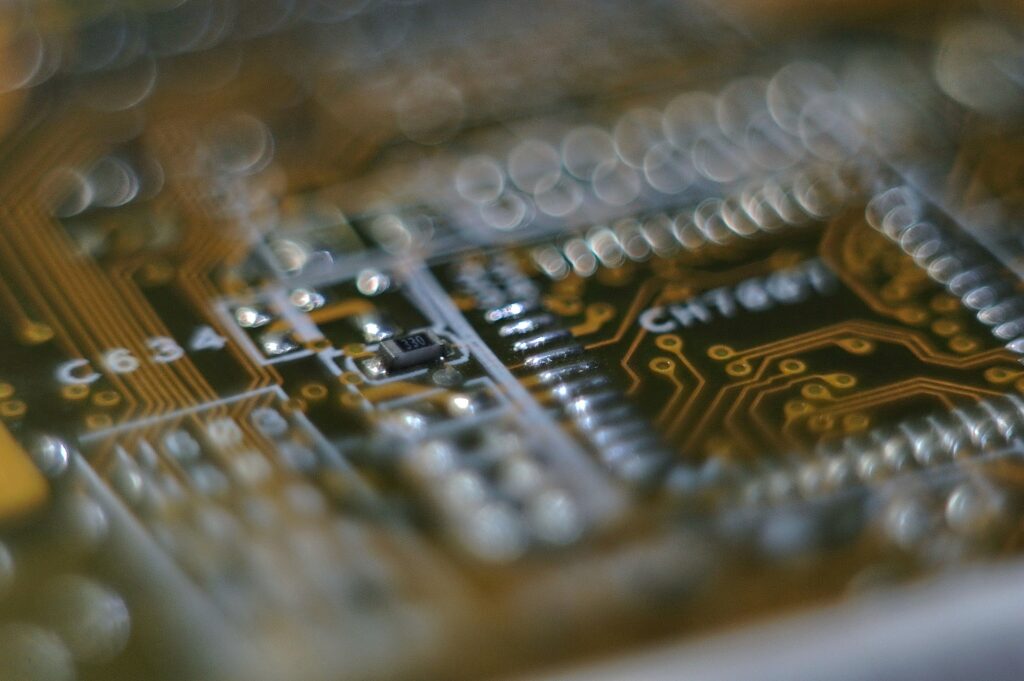

President Donald Trump stated that the imposition of tariffs on oil and gas would be postponed until February 18, 2025. This move is analyzed as an effort to minimize disruptions in the energy market. However, key industrial raw materials such as semiconductor chips, steel, aluminum, and copper are included in the new tariffs.

The semiconductor industry has expressed concerns over this decision, and global IT companies are also worried about potential price increases due to rising production costs. Additionally, the U.S. government has indicated that it is considering imposing additional tariffs on the European Union (EU), signaling further changes in the international trade order. These measures are expected to have a direct impact on supply chains, forcing major manufacturers to reconsider price adjustments in response to rising raw material costs.

The U.S. decision is also anticipated to have a significant impact on the security industry. The increased cost of semiconductors and metal raw materials may lead to higher manufacturing costs for security equipment, potentially resulting in long-term price hikes in security solutions and increased financial burdens for companies.

Companies will need to explore alternative raw materials and production methods to reduce costs. Moreover, as trade tensions with China escalate, the risk of cyber threats, such as Advanced Persistent Threat (APT) attacks, is expected to rise.

With the intensification of the digital war between the U.S. and China, major corporations and institutions face an increased risk of cyberattacks. Some U.S. intelligence agencies and private enterprises have already begun strengthening their cybersecurity infrastructure as part of their response measures, and the cybersecurity market is expected to experience rapid growth.

Additionally, the ongoing conflict between the U.S. and the EU over data protection policies is expected to have a growing impact on the global security industry. Discussions on data sovereignty are likely to resurface, increasing the need for companies to establish stronger data protection strategies. Many global enterprises are currently devising response strategies to balance compliance with both the EU’s GDPR (General Data Protection Regulation) and U.S. data protection laws. This is expected to bring about new changes in data management and security policies.

The latest U.S. tariff policy is anticipated to trigger significant shifts not only in economic matters but also across the security and technology sectors. Going forward, global corporations will have to tackle the complex challenge of ensuring supply chain stability while simultaneously strengthening security strategies.

Furthermore, governments must seek response measures, taking into account the broader impact of trade policies not only on the economy but also on national security and digital infrastructure protection. As the global trade order is likely to be reshaped due to these measures, industries must remain vigilant and adopt strategic responses accordingly.