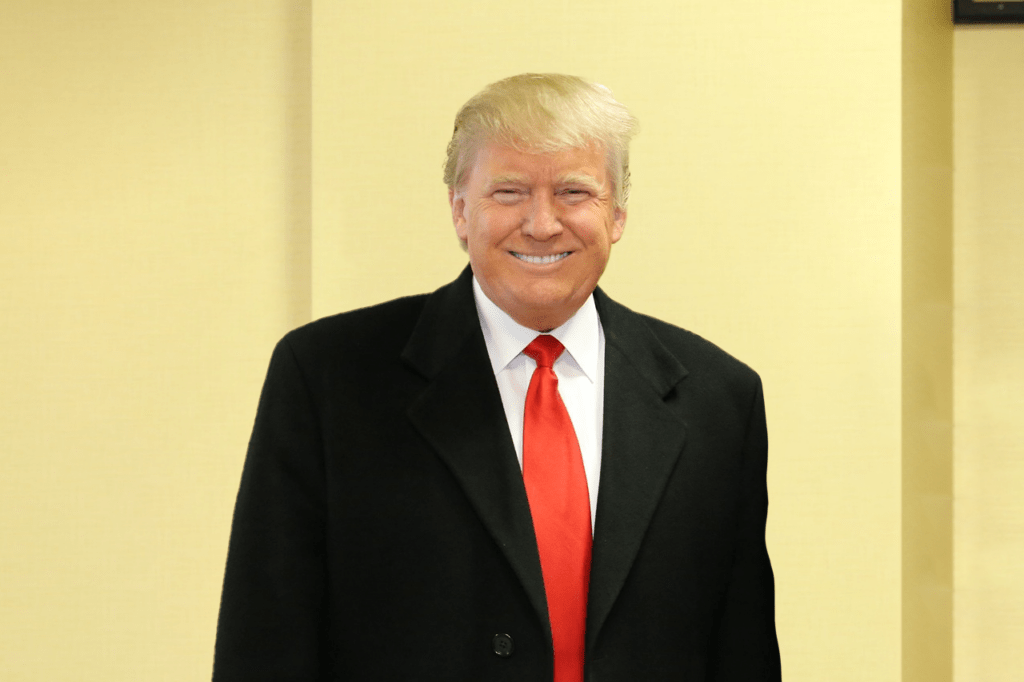

U.S. President Donald Trump emphasized the need for rate and oil price cuts during his keynote address via video at the World Economic Forum (WEF) in Davos, Switzerland, on the 23rd local time. Highlighting the potential impacts on the U.S. economy and the global community, he delivered a strong message to the Federal Reserve (Fed) and global policymakers.

President Trump declared in his speech, “I will demand an immediate rate cut,” adding, “Global rates should also follow ours down.” This statement is interpreted as a call not only for changes to the Fed’s interest rate policy but also for a shift in the global financial market’s rate environment.

Since the early days of his presidency, Trump has expressed strong dissatisfaction with the Fed’s tight monetary policy. He has argued that lowering rates could stimulate corporate investment, expand employment, and further accelerate U.S. economic growth. His remarks are expected to heighten market expectations for a rate cut ahead of the Federal Open Market Committee (FOMC) meeting scheduled for January 28-29.

Trump also addressed international oil prices, stating, “I will ask Saudi Arabia and OPEC to lower oil prices.” He asserted, “If oil prices go down, the Russia-Ukraine war will end immediately,” arguing that high oil prices are enabling the continuation of the war.

He stressed, “Oil prices must come down, and then the war can end,” highlighting that stabilizing the energy market could contribute to global peace. This statement links energy policy to geopolitical conflicts and is interpreted as a message of pressure on global leaders.

By simultaneously addressing interest rates and oil prices—two critical economic variables—President Trump showcased a strong determination to influence domestic and international economic policies. Experts believe his remarks will have short-term impacts on financial and energy markets but note potential limitations due to the independence of the Fed and OPEC.

The Fed, adhering to its principle of independence from political pressures, may not necessarily reflect Trump’s demands in its decisions. Likewise, OPEC, entangled in the interests of its member countries, may find it challenging to make drastic adjustments to oil prices in the short term.

Trump’s comments once again highlight the U.S. stance on global issues such as interest rates, oil prices, and geopolitical conflicts. The upcoming FOMC meeting and international oil price trends are expected to remain key variables shaping the global economy.