In March 2025, the National Assembly of the Republic of Korea passed a long-discussed reform bill for the National Pension Service. The ruling and opposition parties reached a final agreement on the reform bill on March 20, and the next day, March 21, it was passed through a plenary vote.

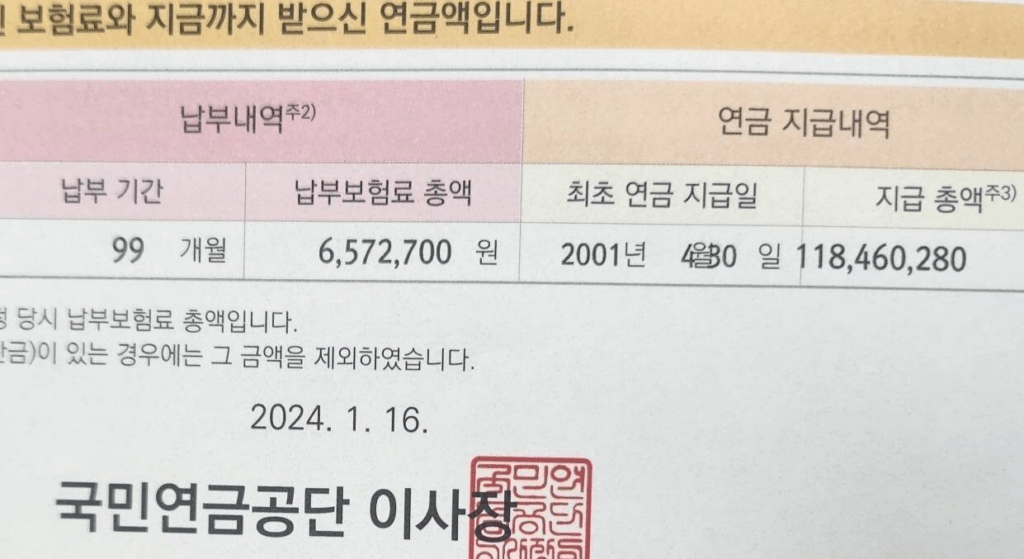

The core of the amendment is to raise the contribution rate from the current 9% to 13% and to adjust the income replacement rate from the existing 40% to 43%. The government projected that this would delay the depletion point of the National Pension Fund from the currently expected 2056 to 2071. This reform carries significant institutional meaning as it is the first pension system overhaul in 18 years since 2007.

However, controversy erupted immediately after the bill was passed. In particular, there was strong backlash from the younger generation. While the reform may have secured some sustainability for the pension system, critics argued that it placed a greater burden on the youth to maintain the benefit structure for the older generation. Some young people openly expressed dissatisfaction with the “pay more, receive less” structure, revealing fundamental doubts about the system itself. The pension system is increasingly being perceived not as a public mechanism for securing old-age income but as a growing financial burden.

Voices of criticism also emerged within the political sphere. Lee Jun-seok, a lawmaker from the Reform Party, argued right after the passage of the bill in the National Assembly that the reform was a rushed agreement that ended merely with a contribution rate hike without structural discussion. On March 30, he likened the National Pension System to a “Ponzi scheme,” stating that a system in which the current generation’s pension is paid through the future generation’s contributions is not just. Although provocative language was used, there was some public sympathy, as the comments reflected concerns about fairness and intergenerational trust within the system.

Public sentiment appears to go beyond simple backlash to resemble an “accumulated fatigue.” Each time political circles speak of reform, the recurring fear of “fund depletion” followed by a “premium hike” has become a familiar narrative. Yet there is still no clear confidence that the benefits of the system will actually return to the contributors. While the pension system remains mandatory, trust in its effectiveness is increasingly eroding.

The lack of communication from the political sphere during the reform process also added to the public’s disappointment. Although the ruling and opposition parties relatively quickly reached an agreement and processed the bill, many pointed out that there was insufficient dialogue or public discussion with the citizens. A reform of a system like pensions, where long-term trust is key, requires not just numerical adjustments but also national consensus to be considered a true reform. While the system can be redesigned through legal means, trust in the system must be built over time.

Additionally, criticism has arisen over whether this reform approached fundamental structural changes rather than just numerical tweaks. Many experts point out that merely raising the contribution rate and adjusting the income replacement rate is insufficient to ensure the sustainability of pensions in a rapidly aging society with a declining working population. A multifaceted approach is needed—including transparency in fund management, closing coverage gaps, and linking with private pensions—but such discussions were not sufficiently included in this reform.

As of March 31, 2025, the legislative process for pension reform is concluded, but the societal debate is just beginning. To restore intergenerational trust and secure fairness in the system, responsible political leadership and continuous communication with the public are essential. The pension is not just a welfare program—it is a system based on a social promise of solidarity and coexistence across generations. Maintaining the system is important, but what is just as crucial is whether people can “trust” the system. Pension reform must not end with numerical adjustments. It is an issue that society as a whole must carefully consider and redesign together.