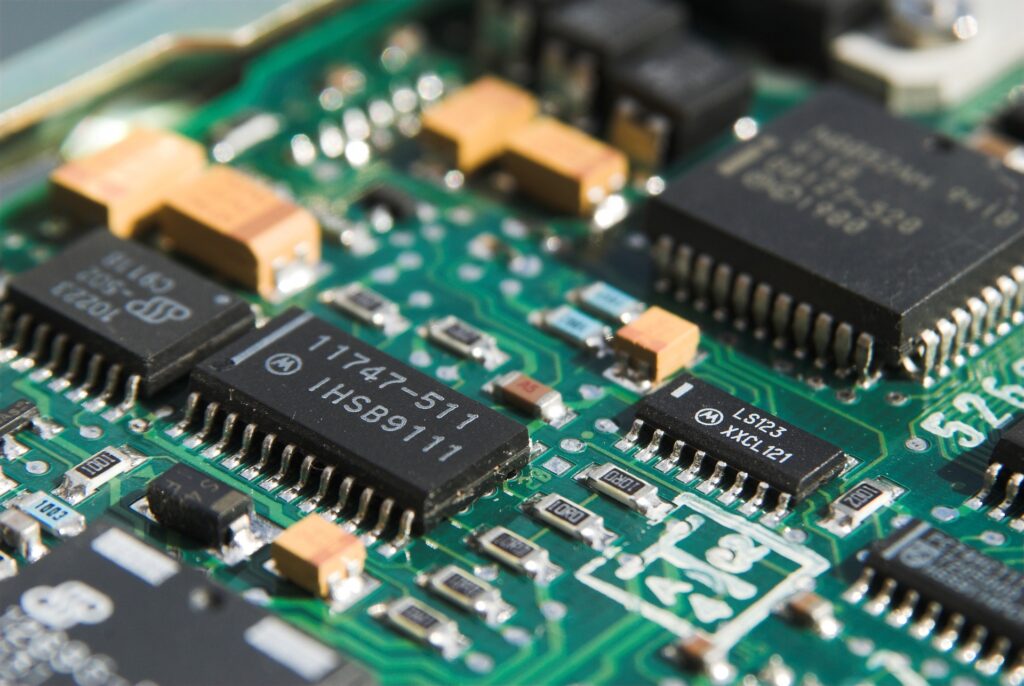

On the 4th local time, U.S. President Donald Trump expressed strong opposition to the CHIPS Act in a joint address to the U.S. Congress, calling for the repeal of the legislation. He stated, “We are providing hundreds of billions of dollars in subsidies, but it is meaningless,” emphasizing, “We must eliminate everything related to the CHIPS Act.” He argued that instead of providing subsidies to companies, it would be more appropriate to impose high tariffs to induce domestic manufacturing in the United States. This stance directly contradicts the legislation introduced by the Biden administration in 2022 to enhance the competitiveness of the U.S. semiconductor industry.

Trump’s remarks are likely to have a significant impact not only on U.S. semiconductor manufacturers but also on the global semiconductor supply chain. The U.S. government aimed to expand domestic production and stabilize the global supply chain through the CHIPS Act, but if this policy is reversed, companies will inevitably have to adjust their strategies. Currently, the semiconductor industry is closely linked to various advanced technologies such as AI, autonomous driving, and 5G, and the ripple effects of policy changes are expected to be substantial.

Trump’s comments could also significantly impact South Korean semiconductor companies, including Samsung Electronics and SK Hynix. Samsung Electronics is currently constructing a semiconductor plant in Taylor, Texas, with an investment of approximately $37 billion, while SK Hynix is also pursuing investment plans for production facilities in the United States. These companies had anticipated receiving a certain level of subsidies from the U.S. government, but if Trump returns to power, such support may be discontinued.

If the U.S. government repeals the CHIPS Act and implements a high-tariff policy, South Korean semiconductor companies will face significant burdens in maintaining production in the U.S. Additional investment costs and operational risks will inevitably increase, necessitating the adjustment of business strategies. Particularly, since Samsung Electronics and SK Hynix play crucial roles not only in the U.S. market but also in the global semiconductor supply chain, changes in U.S. policy may affect not just their operations in the U.S. but their overall industry strategies.

Furthermore, if Trump’s policy direction intensifies trade conflicts with China, the export environment for South Korean semiconductor companies to China may also change. The U.S. has already imposed restrictions on semiconductor exports to China, and there are concerns that such regulations could be further tightened. As a result, South Korean companies may feel pressure to diversify production bases and reassess their positions in the global market, including the U.S. and China. Additionally, since Samsung Electronics and SK Hynix rely heavily on U.S. and European suppliers for advanced equipment essential for semiconductor manufacturing, expanded trade sanctions could disrupt technology adoption and production efficiency.

It is not yet certain whether Trump’s remarks will translate into actual policy changes. Since the CHIPS Act was passed through the U.S. Congress, it cannot be immediately repealed by a president’s unilateral decision. Moreover, there is a widespread recognition within the U.S. that fostering the semiconductor industry is essential, making it more likely that the legislation will be modified in the form of subsidy reductions or policy adjustments rather than being entirely repealed.

Amid this uncertainty, South Korean semiconductor companies need to carefully assess the risks associated with investments in the U.S. and establish strategies to prepare for various scenarios. As the U.S.-China technological rivalry intensifies, reducing dependence on specific countries and diversifying production bases will become even more critical. Additionally, it is essential to continuously monitor political changes in the U.S. and collaborate closely with the government and industry stakeholders to devise optimal countermeasures.

It remains uncertain whether President Trump’s remarks are merely political rhetoric. or will lead to actual policy changes. However, given the semiconductor industry’s significant role in the global economy, South Korean companies must conduct a thorough analysis of potential changes and prepare meticulously. In particular, companies like Samsung Electronics and SK Hynix must quickly respond to regulatory changes in both the U.S. and China and enhance their technological competitiveness by expanding research and development (R&D) investments to secure long-term competitiveness.